vermont state tax brackets

Income tax tables and other tax information is sourced from the Minnesota Department of Revenue. Please provide the requested information from your drivers license or state-issued identification card.

Vermont Income Tax Vt State Tax Calculator Community Tax

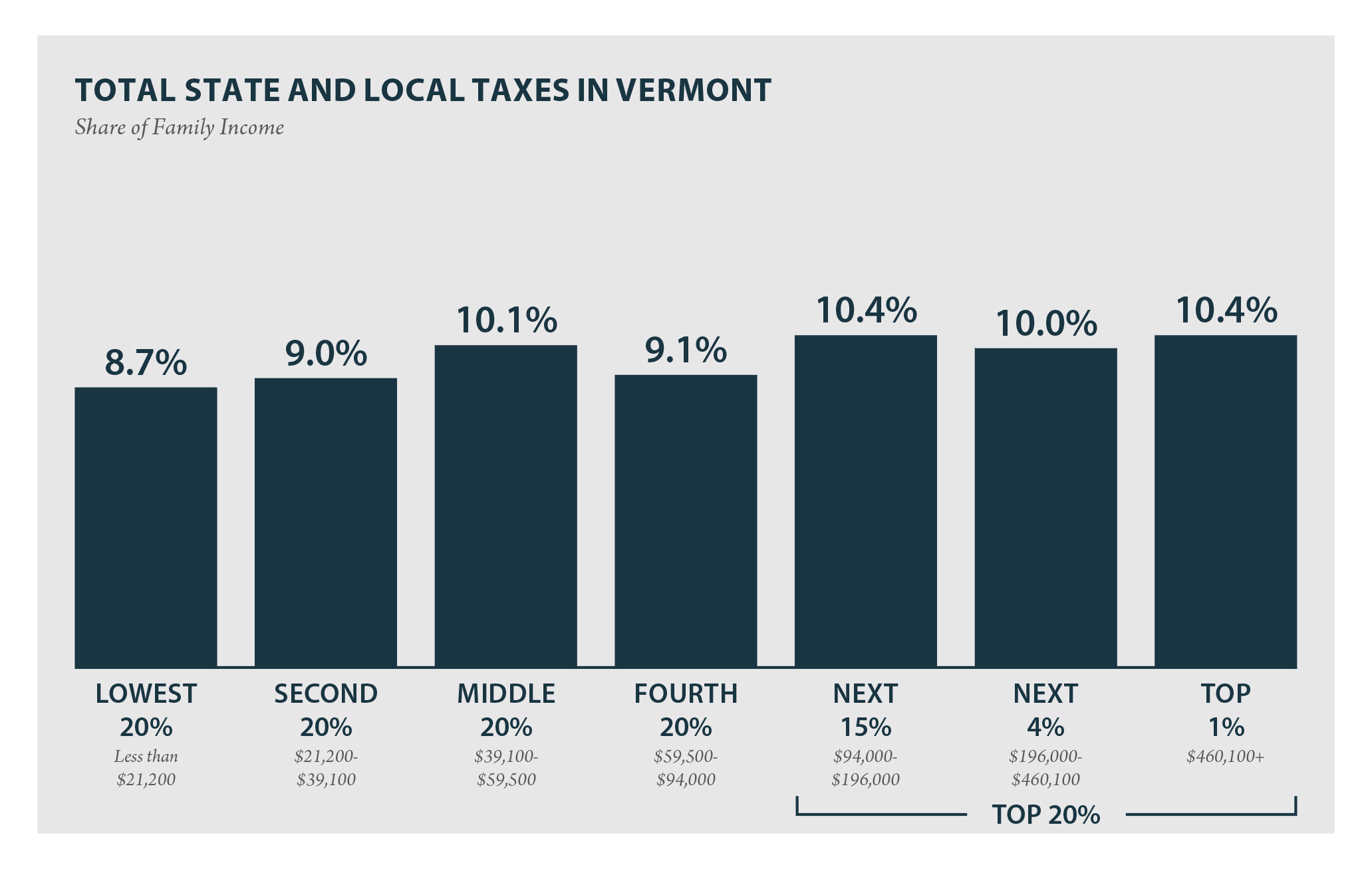

Meanwhile total state and local.

. How does Vermont rank. The first step towards understanding Vermonts tax code is knowing the basics. Alabama a b c 200 0.

Each states tax code is a multifaceted system with many moving parts and Vermont is no exception. For the 2021 tax year the income tax in Vermont has a top rate of 875 which places it as one of the highest rates in the US. The State of Vermont is requesting additional information this filing season in an effort to combat stolen-identity tax fraud and ensure that your hard-earned tax refund goes to you.

There are only seven states nationwide that dint collect a state income tax - however when a state has no income tax it generally makes. Minnesota state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with MN tax rates of 535 680 785 and 985 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. State Rates Brackets Rates Brackets Single Couple Single Couple Dependent.

Your return will not be rejected if you do not have a drivers license or state-issued identification and. State Individual Income Tax Rates and Brackets 2021 Single Filer Married Filing Jointly Standard Deduction Personal Exemption. This page has the latest Minnesota brackets and tax rates plus a Minnesota income tax calculator.

2021 State Income Tax Rates and Brackets. Both Washingtons tax brackets and the associated tax rates have not been changed since at least 2001. Minnesotas 2022 income tax ranges from 535 to 985.

Below we have highlighted a number of tax rates ranks and measures detailing Vermonts income tax business tax sales tax and property tax systems. The Minnesota tax rate is unchanged from last year however the income. Washington has no state-level income taxes although the Federal income tax still applies to income earned by Washington residents.

Of state tax collections1 Their prominence in public policy considerations is further enhanced in that individuals are actively responsible for filing their income taxes in contrast to the indirect payment of sales and excise taxes. Forty-two states levy individual income taxes. Vermonts tax system consists of a state personal income tax estate tax state sales tax local property tax local sales taxes and a number of additional excise taxes on products like gasoline and cigarettes.

Minnesota Income Tax Rate 2020 - 2021. Forty-one tax wage and salary income while one stateNew Hampshireexclusively taxes dividend and.

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

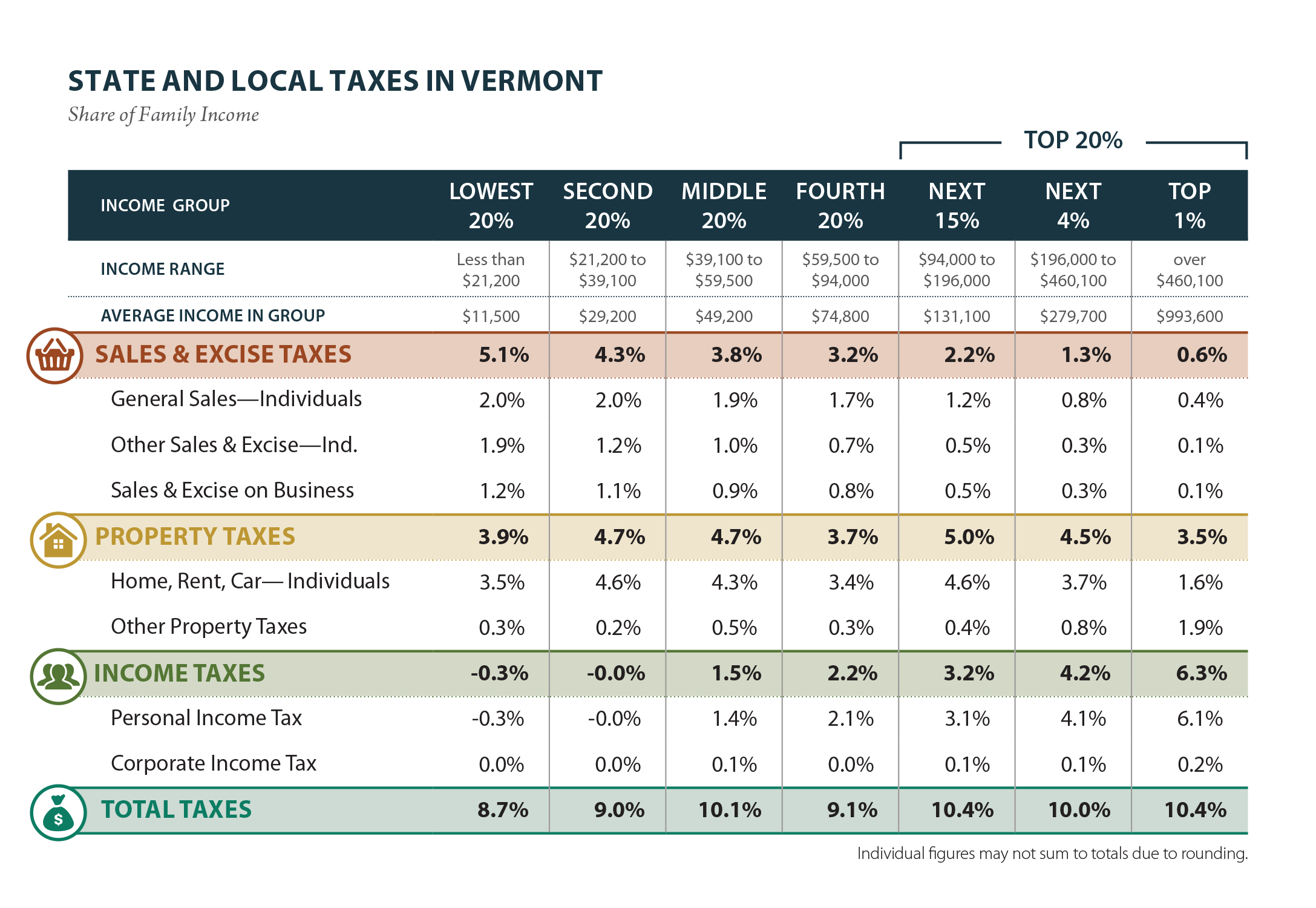

Vermont Who Pays 6th Edition Itep

Vermont Property Tax Rates Nancy Jenkins Real Estate

Historical Vermont Tax Policy Information Ballotpedia

Vermont Income Tax Vt State Tax Calculator Community Tax

Effective State Income Tax Map Public Assets Institute

Vermont Who Pays 6th Edition Itep

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine